In times of financial urgency, payday loans offer a convenient solution for those who need cash fast. LoanPig will help you navigate the complex landscape of payday loans here in the UK, providing you with all the information you need to make an informed decision.

While payday loans can provide quick financial relief when you need cash fast, it’s important to approach them with caution. Choose a reputable lender who offer transparent terms and fair rates. Remember, informed borrowing is responsible borrowing.

Everything You Need to Know About Payday Loans?

Payday loans are short-term cash advances designed to help you cover immediate expenses until your next payday. Typically, these loans are characterised by their high interest rates and short repayment periods.

Repayment periods can be from 1 – 6 months or even longer and the loan amount can be anywhere from £100 – £1500, but you choose what term you are comfortable with and what you can afford.

Payday loans are similar to emergency cash loans where you can borrow a small amount over a short period when you really need them. Our loans are unsecured, so like no guarantor loans, don’t require any collateral. You don’t need personal property to secure them and do not require a guarantor either.

A payday loan in America is quite different to here in the UK, each state has it’s own APR % and they each have their owns rules on how they offer payday loans and short term loans.

Choosing the Right Payday Loan here in the UK

Choosing the right payday lender is crucial to avoid exorbitant fees and unfair terms. Here are some of the top considerations:

- APR and Fees: Always compare the Annual Percentage Rate (APR) from multiple lenders. The APR includes the interest rate plus any additional fees charged by the lender.

- Repayment Terms: Understand the repayment terms offered by the lender. Some lenders provide flexible repayment options, allowing you to extend your loan term without additional costs.

- Speed of Funding: Many payday lenders offer same-day funding, which is crucial if you need immediate access to cash.

- Eligibility Requirements: Check the basic requirements, which typically include being over 18 years old, a UK resident, and having proof of regular income.

- Transparent Fees and Charges – We believe in transparency, which is why we make all of our fees and charges clear and easy to understand. You will never be surprised by hidden fee or charges when you apply for a payday loan with LoanPig.

- Responsible Lending Practices – We are committed to responsible lending practices, so we will only approve a payday loan you can afford to sustain. We’ll check your credit score and current financial situation when assessing your application. If we can offer payday loans for bad credit, we’ll do so if it matches what you can afford and won’t cause financial difficulties during the loan term.

Payday Loans UK – FCA Authorised, Trusted Lenders

Our lending arm partner The Money Hive Limited are fully authorised by the Financial Conduct Authority (FCA) as short-term payday loan direct lenders and brokers. When using us to find the best UK payday loans, you can trust your application will be treated fairly and all terms and conditions will be transparent so there are no hidden surprises.

As trusted direct lenders, we want you to be confident that using our platform can provide the best options for you, and remember if we can’t help you with a loan ourslelves, we pass you details securely to our panel of lenders for you, who may be able to help you.

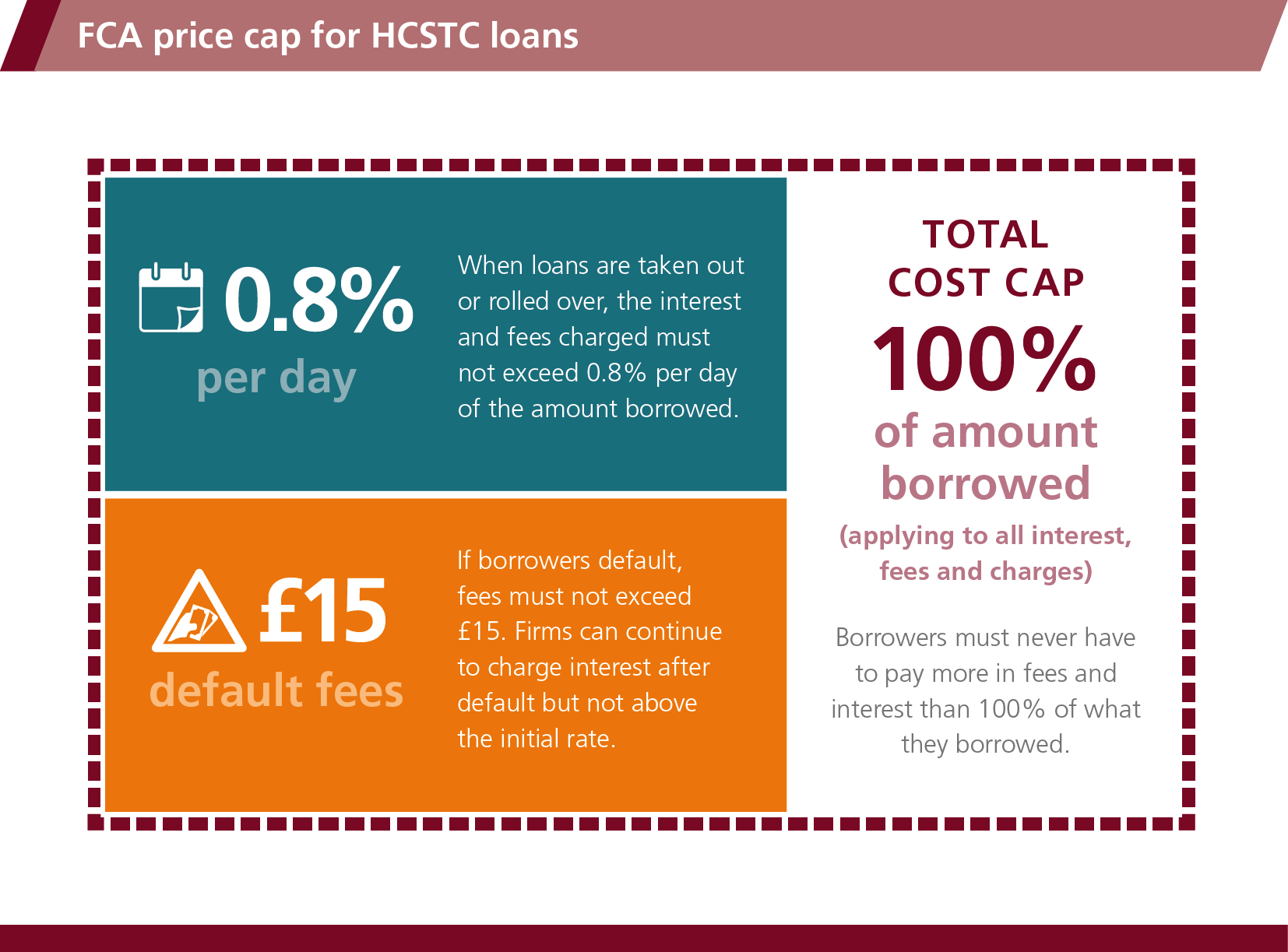

There are many rules that FCA-authorised UK direct lenders must follow when offering instant loans, including a price cap on the interest, fees and charges:

You must ensure that any lender you use is authorised and regulated by the FCA. LoanPig’s FCA registration number is 736632.

Frequently Asked Questions

Is LoanPig a Regulated UK payday loan direct lender?

You can have complete peace of mind when you take out a loan with us because we are authorised and regulated by the Financial Conduct Authority. Our registration number is 736632. Our lending arm is The Money Hive Limited

Can I apply for Payday Loans if I have bad credit?

Payday Loans are available to anyone, the criteria varies from lender to lender but generally anyone who needs a loan quickly, whether they have bad credit, a student or are self employed. Our loan application process means that we will go through your application and consider elements of your credit score and history, via open banking, that other lenders won't.

How quickly are Payday Loans made available to me?

If you are accepted by us or one of our lenders for a Payday Loan, then you should receive the money into your bank account within a couple of hours (on average), but sometimes as quickly as 15 minutes.

How Do I Apply For a Payday Loan?

Applying for a payday loan with LoanPig is typically a straightforward online process, but it’s important to have all your documents ready.

Most lenders will require

- Personal identification

- Proof of income

- Bank account details

- We’ll ask you to complete Open Banking to confirm your affordability to ensure a payday loan is right for you. (Open Banking is completely secure)

Payday Loans UK Direct Lender

If you’re looking for a payday loan from a UK direct lender, it’s important to know the difference between applying through a direct lender and using a broker. As a UK-based direct lender, we process your application ourselves without passing your details on to third parties. This means you get a quicker decision, better privacy, and clear communication from the start. We assess each application fairly and aim to offer responsible payday loans that suit your financial situation.

Many people prefer to borrow from a UK direct lender because it offers more control and fewer surprises. When you successfully apply with us, you’ll know exactly who you’re borrowing from. If you want a fast, simple, and transparent experience, choosing a payday loan direct from a UK lender like us is the smart option. Learn more about how our payday loans work or view our flexible loan options.

Financial Implications and Responsible Borrowing

It’s vital to understand the financial implications of payday loans. High APRs can make these loans costly over time. Always use payday loans for short-term financial needs, not as a long-term financial solution. Plan your budget carefully and ensure you can repay on time to avoid additional charges.

Also bear in mind that using a payday loan in an emergency can save you money in the short and long term, for example if you borrow £300 for 1 month you’ll pay approx £70 in interest. we have helped many different customers with various requirements get cash loans quickly.

Alternatives to Payday Loans

Before applying for a payday loan, consider alternatives such as:

- Credit union loans: These often come with lower interest rates.

- Overdrafts: Some banks offer interest-free overdrafts up to a certain limit.

- Government financial support: Check for eligibility for government grants and support.

Payday Loans for Bad Credit

If you’re considering short-term loans, it might be due to a poor credit history or low credit score. This can often limit the options available to you with conventional high street lenders. They need a good level of credit to help. Bad credit might arise from missed payments or defaults on loans in the past, which can significantly affect your current credit score.

No matter your financial past, if you need quick financial help and have a low credit score, our loans could be a solution. As responsible direct lenders regulated by the FCA, we conduct credit and affordability checks to ensure fairness and responsibility in our lending practices.

We’ll never offer a loan that you cannot sustain the repayments for, ensuring your financial health is a priority. If you need more information about our payday loan options, please contact us.

LoanPig’s Payday Loan Criteria

At LoanPig, we understand the urgency when the unexpected happens. We aim to make the process of applying for a UK payday loan as quick and straightforward as possible. Here’s what you’ll need to provide to start your application today:

- be a current UK resident

- be at least 18 years old

- have an active bank account and a valid debit card

- either be in permanent employment or receiving some form of disability/living allowance or a pension

- be in a position to confidently afford the monthly repayments

After verifying these details, we’ll quickly process your application, which includes a full credit check. We review your personal and financial information along with your credit score to make sure the loan fits your financial situation and you can sustain the repayments. If approved, we aim to transfer funds to your bank account the same day, or the next working day if the application is after 3 pm or over a weekend.

If you have any questions, please don’t hesitate to contact us.