What Are Short Term Loan Direct Lenders?

A short term loan direct lender is a company who can lend to you directly themselves. They are authorised and regulated by the Financial Conduct Authority. They will clearly show their interest rate including PA fixed-rate and ensure you have read their terms and conditions when making an application.

These direct lenders, including LoanPig, practice responsible lending. Our process for short term loans and payday loans, as a UK direct lender, has been designed to give you access to our funds but also a number of different lenders, at the push of a button. A direct lender will ensure that you are fully aware of any late repayment warnings and penalties and your right to early repayments, and a clear document stating your monthly repayments and interest rate. This assures you that your loan will be from a reputable source and in your best interests no matter your credit history.

Why are LoanPig Loans better?

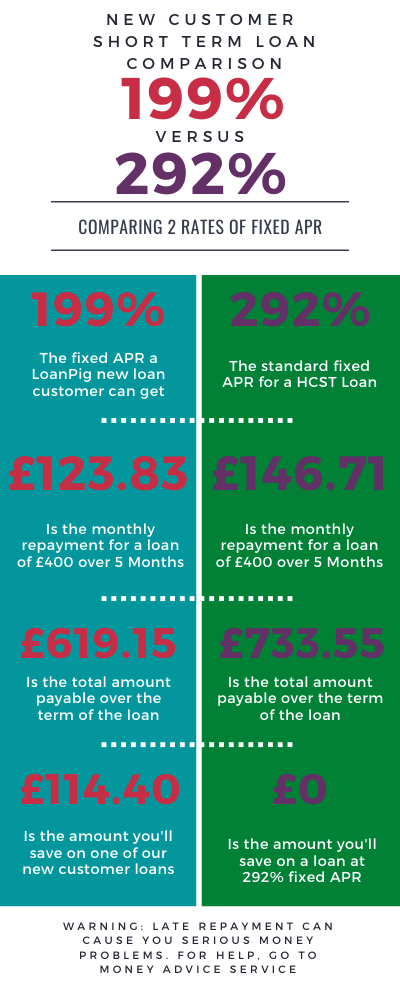

As a new customer of LoanPig’s* you could get a loan with a rate of 199% fixed APR (subject to status), “what does that mean?” we hear you ask. We’ve pulled together a comparison chart for you below to help explain.

The representative APR per year on a new customer loan would be approx. 530%

Short Term Loans from a Direct Lender

Finding yourself in financial difficulty can be quite a stressful situation. If you need money urgently, thankfully, there are several options available to you, including applying for a loan with short term loan direct lenders like LoanPig, even if you have poor credit as we have short term loans for bad credit.

As a direct lender, we put our customers at the forefront of our thinking around short term loan lending. This means considering those with bad credit scores, as we look beyond your credit score and understand what your past, present, and future circumstances are, to find you the best solution for you.

Frequently Asked Questions

What is a Short Term Loan Direct Lender?

A short term loan direct lender is a company who can lend to you directly themselves. They are authorised and regulated by the Financial Conduct Authority.

Are Direct Short Term Loan Lenders Regulated?

All direct lenders, short term lenders (including those who are set up to provide loans for those with bad credit) must follow the regulations put in place by the Financial Conduct Authority.

Why Should I Choose LoanPig?

LoanPig is an excellent Short Term Loan direct lender for people who want a loan because if we can't lend to you one of the lenders in our panel will, especially if you currently have bad credit. You can choose how much you would like to borrow and set up a repayment plan based on what you can afford to pay.

What Is The Difference Between Short Term Loans Direct Lenders And Brokers?

Short term loans direct lenders and brokers offer entirely different services and it’s important to be able to differentiate between the two and ensure that you are dealing with the right lender for you.

Both direct lenders and brokers claim to have high acceptance rates, meaning that even if you have a bad credit score you have a high chance of having your loan application accepted.

How Much Will I Repay With A Short Term Loan Direct Lender?

The amount you pay back to short term loan direct lenders depends on the amount you are wanting to borrow, and how long you want to borrow this amount for. Our direct loans calculator will determine exactly how much you’ll repay based on the amount you want to borrow and the amount of time in which you want to pay it off.

For example, if you want to borrow £500 over the course of five months, then you would expect to pay £416.94 in interest, making your total repayable amount over the five months a total of £916.94.

Can I Apply For Short Term Loans Online?

At LoanPig, we only offer our short term loans online. This is because we want to remove stressful telephone conversations. We need information from you which ultimately enables us to loan to you ourselves or to connect you to a different lender.

This simplifies the process and ensures that you can access the money you need quickly, without stress and with the help of an ethical and reputable short term loan bad credit direct lender.

There are now strict rules and regulations in place that ensure short term loan lenders act in their clients’ best interest.

An example of one of these changes is that now customers can never pay back any more than double what they borrowed. You can rest assured that any loan you take out through our short term loans direct lenders will be provided to you in an honest and transparent way, with your needs and rights at the forefront of our minds.

What Are The Alternatives To Using A Short Term Loan Lender?

If you are in dire need of financial support but you feel as though a short term loan isn’t the right option for you then there are alternative solutions to help you recover from your financial difficulty, including applying for bank loans, asking to borrow money from your loved ones or else selling your belongings to cover the additional cost. Despite these options, there are very few options where the money you need can be raised as quickly as if you were to take out a short term loan.

Can I Apply For A Short Term Loan With A Bad Credit Rating?

Having a bad credit rating can put you at a disadvantage when applying for traditional loans and short term loans for bad credit often consider every application as an individual – having a poor credit rating, for example, should not impact your chances of taking out a loan if you have the financial means to meet your repayments.

As a short term loan direct lender, we evaluate whether you are eligible for a loan based on a number of different criteria, not just whether your credit rating is good.

Will Borrowing Money From A Short Term Loan Direct Lender Impact My Credit Score?

If you are consistently making repayments on your loan, there is absolutely no reason why your credit score would be impacted by the loan. Failure to meet repayment schedules, on the other hand, will affect your score so when deciding to take out a loan, you should consider whether or not you can afford the repayment plan and meet your repayment deadlines when applying through short term loans direct lenders.

For more information on the services that we provide or to apply, get in touch with us today.

Other Frequently Asked Questions

What are the common uses for short term cash loans?

Short-term loans are often used for emergency expenses, unexpected bills, cash flow issues in a business, or bridging financial gaps until the next paycheck.

What are the eligibility requirements for quick short term loans?

Eligibility criteria as short term loans bad credit direct lenders include age requirements (18 or older), proof of income, and a checking account, amongst other things.