£50 loans from LoanPig can be a great short term solution to your financial difficulties. Whether it’s a quick loan you need to help you through to pay day, or it’s an emergency, unexpected bill, we are able to offer small loan amounts, so you can receive a £50 loan instantly. Also offering loans up to £1500, you have the power of choice when it comes to the loan amount, with repayment terms from 1 – 12 months, depending on your financial situation and preference.

What can LoanPig offer me?

As a unique direct lender and broker, providing a variety of loan amounts, we are here to help tide you over until your next payday. Sometimes you might not need a huge loan of a few hundred pounds, which is why a £50 loan from a direct lender such as LoanPig is ideal to carry you over until your next payday arrives.

Not many lenders offer payday loans at prices as low as our 50 pound loans, usually offering loans starting at £100 or higher. However, we at LoanPig understand that unforeseen circumstances can sometimes leave you in need of financial assistance, even if it is just a £50 loan. With LoanPig, you don’t have to worry about any upfront costs as we don’t charge any fees.

How Much Interest Do I Have To Pay On A £50 Loan In The UK?

We offer a variety of options when it comes to repaying your £50 loan in the UK. Here are the representative prices you’d have to pay back depending on your loan length. It’s worth bearing in mind that the quicker you choose to pay back your 50 pound loan, the less interest you’ll have to pay.

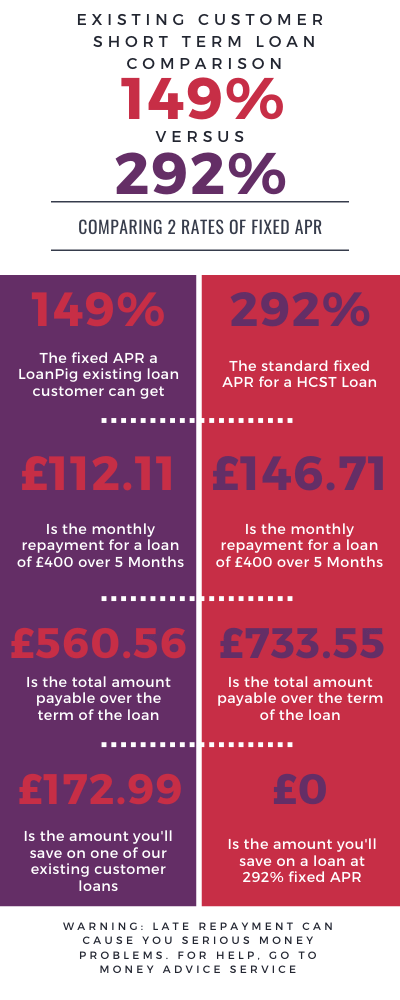

Here’s a representation of how much you’d have to repay with a fixed 292% APR when taking out 50 pound loans over certain timeframes:

– 1 Month – £62.17

– 2 Months – £68.91

– 3 Months – £76.09

– 4 Months – £83.69

– 5 Months – £91.69

– 6 – 12 Months – £100

What Are The Benefits of £50 Loans?

£50 personal loan can have many perks, sometimes with life changing benefits. The various perks that a 50 pound loan from a direct lender can have include:

– It’s a speedy financial fix

– We cater to all credit rates

– You’ll receive the funds on the same day or the next working day

– Our acceptance rates are high

– We consider your affordability/circumstances as well as credit

– It’s discrete – No need to ask a bank manager or family member

– Provides an option when there are no others

Why Choose LoanPig As A £50 Loan Direct Lender?

£50 loans in the UK at LoanPig are a leading option with many borrowers using our services for a variety of reasons. £50 loans are instant and can cover any emergency immediate costs you may have, allowing you to benefit in the short term.

As responsible lenders, we have to ensure that your motivation for £50 loans can be supported by your finances. As we work to FCA guidelines, along with our panel of £50 loan lenders we can connect you with, your application will be subject to a full credit check and careful assessment of your finances. As part of our commitment to transparency with your application, we work to several rules:

– LoanPig charges a maximum interest of 0.8% per day.

– LoanPig can only charge a one-time late penalty fee of £15.

– LoanPig ensures that customer will never pay more than double the amount they borrowed.

– £50 loans at LoanPig are fixed at an APR of 292%.

If we can approve your £50 loan application, you can expect a quick pay out and the exact financial support you need in an instant.

What’s The Best Way To Use My £50 Loan?

Whether it is a £50 loan or a larger loan amount, when taking out a loan, you can use it on anything you desire. However, we do advise that you only take out a payday loan when it is an emergency as a last resort. Saving up money should be your first priority.

Payday Loans are frequently used for:

– Emergency Repairs (e.g. car repairs)

– Unexpected Expenses (e.g. larger heating bills)

– To cover a small bill

Am I Eligible For A £50 Loan?

All applicants who desire a £50 loan will be required to prove their affordability through an income assessment and credit check. If you are approved, you’ll either complete your application with us, or through one of our lending partners’ own website. To be eligible to apply for £50 loan, you will need to:

– Be a UK resident

– Must be aged 18 or over

– Be in employment (in some circumstances other forms of income may be considered)

– Be able to meet the affordability/credit checks that we and our panel of lenders request

– Hold a UK bank account

My Credit Isn’t The Best, Will I Still Be Able To Borrow £50?

With 50 pound loans in the UK, all loan applications are subject to a full credit check, but your credit score is not the only criteria used for consideration. As both a £50 loan direct lender and a broker, LoanPig uses a trusted panel of lenders, who are often prepared to lend to clients who have a low credit score.

If you have any further concerns regarding prior financial difficulties, you have a bad credit rating or have never borrowed before, you don’t need to worry, we will be assessing your current affordability, rather than dwelling on the past. £50 loans can provide a lot of flexibility when it comes to the payback period, which is why when you apply, we’ll match you to the best offers for £50 loans in an instant.

£50 Loans FAQs

Are £50 Loans Right For Me?

FCA regulated payday loan lenders are there to help you resolve an emergency situation if you can’t do so through over means. They provide essential funding for situations that arise unexpectedly and can be a theoretical lifesaver for some who use them properly. One of the first things you should do before applying for cheap loans is think about whether or not you actually need it. Those who need to pay for something considered time-sensitive could benefit greatly from taking one out, as long as you can afford to repay it.

Can I Apply for £50 Loans Without a Credit Check?

The short answer, no. It is a legal requirement with any loan, including £50 loans in the UK, to carry out a credit check. Even so, if you have bad credit, it is still possible to apply for £50 loans in the UK with LoanPig. You will need to undergo a credit check, but this is not the be-all and end-all and we use other criteria such as your current affordability rather than fixating on the past and penalising you for previous action that may have resulted in your credit score being low. No lender can legally provide you with a loan without a credit check and a credit check ensures not just the lender is protected, but you are too. We simply need to ensure you can make the repayments you have applied for as a responsible lender.

How Quickly Will £50 Loans Pay Out?

When you apply, you will receive an instant online decision. If you are accepted by us or one of our lenders for a £50 loan, then you should receive the money into your bank account the same day, sometimes within a couple of hours. If your application is made and approved after 3pm during working days or at a weekend or bank holiday, the funds will transfer to your bank account the next working day.

How Can I Get the Best £50 Loan In The UK?

To get the best deals on 50 pound loans, you’ll need to ensure that your credit rating is in the best possible shape. The higher your credit score, the better your chances of being approved for £50 loans. LoanPig has a panel of lenders offering £50 loans in the UK, matching you with the lender most suitable for you. The very best deals are reserved for applicants that can demonstrate good credit and high affordability. If you do have fair to bad credit, you may find you can still get £50 loans. However, the interest rates may be slightly higher. You’ll need to consider your situation to have the best chance of getting approval for a loan with the best £50 loan terms.